Welcome we will be reviewing macro events from this past week from The Post I made at the beginning of this week on 6/12/22.

I have added a Definitions page which will include all of the terms and abbreviations that I use from now on and will be referred to on every post.

Substack has launched an iOS app for those of you using apple devices. I am an android peasant and can’t tell you if its good or not, but check it out if you have an iPhone or some other such trappings of royalty.

Please feel free to skip around or ignore certain sections if it does not apply to you. The Table of Contents is made to preserve your time in this manner. You can always simply read the conclusion if you are in a hurry.

Table of Contents

Mechanical Liquidations and DeFi

Misc. Potential Liquidations

The ECB

Other Central Banks

Crypto Macro

Conclusion

1. Mechanical Liquidations and DeFi

It’s impossible to call the bottom on a market when liquidations are occurring due to large financial entities that have over-leveraged or failed to properly manage risk heading into this market. We covered the ongoing issue of Celsius on Sunday, and there are quite a few other centralized entities who are still trying to shake off some of the losses incurred from the $LUNA meltdown. Almost every single major institution that is going through issues with loan liquidations had some exposure to $LUNA, some more than others.

Combine that with the current Macro of rates increasing significantly and these entities who probably thought they had a lot more time to figure out how to pay back these loans found themselves getting margin called. And that is the current state of the crypto market. Normally these entities wouldn’t have such massive loans that they couldn’t readily pay off. For instance if $LUNA hadn’t crashed, these entities would probably just be taking haircuts across the board to decrease their loan exposure until their liquidation price might be a $400 ETH price. They wouldn’t be either making major large asset sales to get enough USDC/USDT/DAI to pay back their loans, or allowing themselves to get liquidated as price moves down.

The mechanical issue with this much leverage and collateral that has essentially evaporated is that when a vault on MAKR, or some other form of DeFi is liquidated, the ETH inside of the vault has to be sold on market for stablecoin (which is then burned) in order to keep the supply of stablecoin flat in relation to the collateral within the DeFi ecosystem. The function of MAKR was discussed in Section 4 of January’s crypto macro post when outlining how healthy DeFi liquidations work and how they can be avoided in the context of January’s price crash. This time, the entities with outstanding loans have less ability to simply pay back their loans or add collateral because of what was lost when $LUNA died. I suspect that a lot of the people we see getting liquidated on MAKR and other platforms lately are people who lost a significant amount in $LUNA and were hoping to be able to hold their crypto loans open while making money to repay the loan and got squeezed out.

As they get squeezed out, they drive the price of ETH down further which jeopardizes the next tranche of loans. And on and on until either all the liquidity is squeezed out, or until prices stop bleeding. Now, if you read my post from Wednesday covering the US rate hike, you already know what my price expectations are for the future, and I will cover them again here in section 4.

3AC = 3 Arrows Capital, and they were fairly involved in the $LUNA ecosystem. And we still don’t yet know what their level of exposure/insolvency is, but there seems to be quite a lot of chatter that they are the next big fund to fail. And maybe they will.

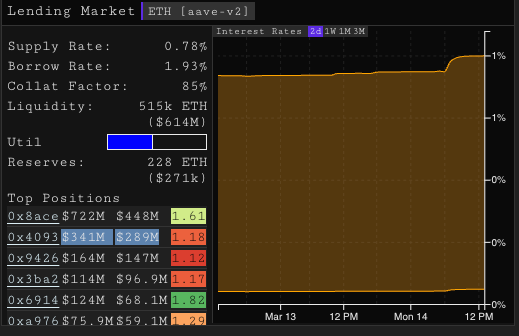

And even beyond them there are a lot of wallets with loans on AAVE and MAKR and other platforms that are either trying to pay back their loans or are getting liquidated. Here is one poor anonymous soul who has added nearly 20,000 ETH to their AAVE loans in order to bring their liquidation price down to avoid having their vault sold off at market value.

Whoever this person is, their sacrifice is noticed. Another thing to consider is as Celsius has now shut down withdrawals, they are very likely insolvent and going to die as a result of the ETH they lost in $LUNA and potentially anything else they may not have taken care of. They’ve locked customer withdrawals. There very well may be some people who are having to make a very tough choice now about loans they have open on Celsius. As prices of assets fall, do they deposit assets on to Celsius to stop their loans from being liquidated by Celsius, knowing full well that Celsius may die anyways and everything they add to Celsius from here on will be lost? Or do they let their loans on Celsius get liquidated? Tough choice, I would hate to have to make it.

But these mechanical considerations of the market are ones that we all need to be keeping in mind, especially when people are trying to call the bottoms. It wouldn’t matter if the Fed began printing money today, if loans are getting liquidated, they will push the price down until there is nothing left to liquidate.

One thing that people should really be noting throughout all of this is just how stable DeFi protocols have been throughout this whole thing. Has AAVE had an outage? No. Were loans frozen or was trading on AAVE halted? No. Have liquidations of vaults on MAKR failed or occurred incorrectly? No. Have users who have the funds been unable to pay back debt? No. Has $DAI lost it’s peg as vaults were liquidated en masse? No. These protocols operate 24/7, 365, with full user transparency, and no matter how much market distress is occurring, they are functioning flawlessly. We talked about pools on Curve depegging when $LUNA collapsed, and on Sunday in regards to the $stETH/$ETH pools, but did Curve ever stop functioning? No, it worked perfectly.

Not to mention with everything on chain, regular people like you and me get full transparency and can see what the wallets of massive financial institutions are doing in real time. There is no room here for back-door bailouts, nor for shadowy government entities to take cuts under the table or to use different rules for their friends and connections than the ones they use for you. This is perfect market equity. It does not get more fair, open, or transparent than this. DeFi is here to stay, and this is exactly why.

Misc. Potential CeFi Liquidations

In many ways this may be a black swan that has been rippling out from the collapse of $LUNA. Several Centralized entities involved in crypto have been feeling the heat lately. Below are some examples with minimal commentary from me because a lot of this is new, unconfirmed and essentially hearsay. Almost anything anyone says about DeFi can be confirmed in real time on the blockchain, but when it comes to Centralized Entities and private dealings that are not on-chain, we can only speculate.

FinBlox is limiting withdrawals.

3AC’s loan from BlockFi was liquidated (maybe for half a billion).

I have been trying to withdraw a relatively small amount of $LINK I left on Nexo because I didn’t know what else to do with it. Since Tuesday I have been told to “try again in a few minutes,” lol.

Thankfully, this represents less than 1% of my total crypto, if it’s gone, I’ll live. I hope that you all have been taking heed as I have been warning you all to take custody and get your assets out of these centralized platforms.

Similar to how Celsius offers users outsize APY’s to take custody of their coins, at the larger level entities like 3AC also offered similar APY’s to large funds in order to take custody of fund assets. I see names in the comments here that I know, so I treat this as a confirmed statement. Meaning that it’s likely some large funds assets were being held as a part of 3AC’s treasury and we will likely be seeing more collapses in time.

The big lesson being learned by many is “Not your keys, not your coins.” This applies at all levels. Too many people have forgotten this, gotten lax, and they are paying the price for it. You often see me saying that all actions are market facing and it is not possible to outrun the consequences of bad market actions. The market always inevitably punishes mistakes. In the long run everything catches up with you. Both in markets and in life.

Keep reading with a 7-day free trial

Subscribe to Flirtcheap’s Asymmetric Economics to keep reading this post and get 7 days of free access to the full post archives.